2022 3rd Quarter Client Letter – Navigating the Energy Transition

By Will Klein, CFA

Quarterly Investment Commentary

A Tale of Two Energy Markets

Over the first half of this year supply shocks from Russia’s invasion of Ukraine drove natural gas, coal, and oil prices sharply higher. Those commodity market spikes threw fuel on the fire of already hot inflation while squeezing consumers at the pump. That highlighted how the return of natural resource nationalism, paired with efforts to transition away from fossil fuels before sufficiently investing in alternative energy, have created energy market vulnerabilities.

Here in the US, those challenges ebbed last quarter. Oil prices fell sharply since their summer peak, with average gas prices declining from over $5/gallon to under $3.75/gallon nationally. Moreover, the recently passed Inflation Reduction Act, which includes $386B in new spending to support energy transition technologies, should catalyze investments in renewable power generation and storage, electric vehicle manufacturing and nuclear energy. While that legislation is not a silver bullet for America’s energy challenges, and domestic energy prices could remain volatile, growing fiscal support for energy transition investments paired with improving commodity market dynamics could help navigate the current energy crunch while smoothing the bumpy road to a more resilient and sustainable domestic energy mix long term.

Europe, meanwhile, is contending with a worsening energy crisis. Power costs have already more than doubled across much of the continent. Moreover, that crisis could worsen if Russia follows through on threats to cut off natural gas exports this winter. That could derail Europe’s anemic economic recovery, pushing the EU and the UK into a recession.

Those developments have significant market implications. Volatile energy prices are adding to uncertainty around inflation. Regional energy market decoupling is contributing to US equity market outperformance. And growing fiscal support for energy transition infrastructure could create investment opportunities within US equity markets. We are working to capitalize on those opportunities and navigate those pitfalls across client portfolios.

3Q22 Market Performance

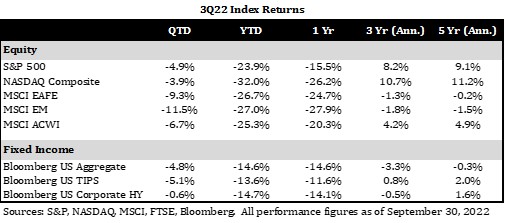

Last quarter was a challenging period for balanced portfolios. US stocks traded down to their November 2020 levels, as continued Fed hiking offset tailwinds from healthy corporate earnings. International stocks, meanwhile, sold off sharply as energy crisis fears and the strength of the US dollar weighed on returns. Fixed income markets, lastly, struggled in response to stubbornly high inflation and tightening monetary policy. Together, those cross-asset headwinds led balanced portfolios to end the quarter at their 2022 lows.

Client portfolios were impacted by those market headwinds. However, within equity markets, our domestic focus insulated clients from the worst of the selloff over the quarter. Meanwhile, within fixed income, our focus on short duration bonds mitigated the impact of the continued move higher in interest rates. Despite those offsetting factors, last quarter marked a challenging period for client returns.

Cross-Asset Outlook

While we avoid market timing, we will express strategic views on asset classes across client portfolios. One of our longest held views is our favorable outlook for US equities over international stocks.

To paraphrase Warren Buffett, we’re believers in the “American Tailwind.” Specifically, we believe the US economy, with the premium it places on innovation and efficiency, will continue to create exceptional value for investors long term. Moreover, we’ve positioned portfolios to catch that tailwind. Over the last five years alone US equities, measured using the S&P, have returned 55% while international equities, measured using the MSCI ACWI ex US, have returned -4%. Our tilt favoring US equities has put clients on the right side of that trend.

Our focus on domestic equities predates the current energy crisis in Europe. However, today’s macro environment has proved favorable for that tilt. Energy rationing and demand destruction concerns have weighed on EU markets, with the MSCI Europe Index returning -29% YTD. While US markets have not been immune to those challenges, our domestic focus has insulated us from that headwind.

Equity Strategy Highlight

Our favorable strategic outlook for US equities is also rooted in our experience investing in the US stock market. Since Baldwin Wealth Partners was founded in 1974, we’ve been active investors in US equities. Over that time, we’ve developed some frameworks for navigating that market. Those center around buying great businesses for good prices and holding them for the long run. Additionally, they reflect our belief that companies that are capitalizing on secular growth opportunities and are leaders on environmental, social, and governance issues should be well positioned to compound shareholder value.

NextEra Energy (NEE), the Florida based electric utility and merchant power producer, fits neatly into those frameworks. NextEra owns Florida’s leading regulated electric utility, Florida Power and Light, and a national merchant power producer and developer business, NextEra Energy Resources. Between those two businesses, the utility is the largest renewable power developer and generator in the US.

When we first added NextEra to portfolios over five years ago, we believed it would be able to leverage its position as a leader in wind and solar to generate profitable growth across its segments. That’s played out over the last five years, as the company grew its renewables generating capacity from 16K megawatts to 23K megawatts. Moreover, that growth could accelerate due to clean energy tax credit provisions in the Inflation Reduction Act. NextEra’s industry leadership, leverage to strong underlying demand trends, and access to opportunities linked to energy transition investment should support long term value creation. So, we believe the utility will remain an attractive core holding long term.

Closing Thoughts

While markets remain volatile, our portfolio construction philosophy is largely unchanged. Across asset classes, we continue to believe high quality, large cap US equities represent an appropriate core allocation for most clients. In addition, fixed income will continue to play a role in portfolios; however, we are looking for opportunities to diversify around those core portfolio building blocks to manage macro and market risks. Within US equities, we continue to believe that high quality, secular growth companies with strong balance sheets should be rewarded during challenging market conditions. Lastly, across other asset classes, we continue to partner with investment managers whose people, processes, and philosophies should help them create value through the cycle.

We remain focused on building portfolios to help you achieve your long-term goals. Please do not hesitate to reach out if you have any questions about your portfolio or our market outlook.