2022 4th Quarter Client Letter – Building Resilient Portfolios

By Will Klein, CFA

Quarterly Investment Commentary

Putting Portfolios Through the Speed Cycle

2022 was a challenging year for investors, as hot inflation, Fed rate hikes, and Russia’s invasion of Ukraine rattled global markets. Moreover, last year’s market turbulence marked only the latest in a string of rapid market rotations investors have had to navigate over this still young decade.

One of the defining characteristics of the last three years has been the speed of this market cycle. Early in 2020, the onset of the COVID pandemic froze wide swaths of the economy, sending markets into a brief freefall. Over the following ~18 months, the US experienced its fastest economic recovery since the 1940s, propelling markets to new highs. However, that expansion proved similarly short-lived, as the Fed hiked interest rates to combat extreme inflation, squeezing growth and weighing on stock and bond returns over 2022. Moreover, this cycle shows few signs of slowing down with most economists forecasting the US will enter a recession over 2023. This three-year sprint from recession to recovery to expansion to slowdown puts the current business cycle on track to become the shortest in over 40 years.

Even so, mounting recession risk does not undermine the strategic case for equities: The US has experienced 7 recessions over the last 50 years, and yet the S&P has returned 10.3% annually over that period. Despite that trend, this rapid macro and market rotation does underscore the need for a robust through-cycle approach to portfolio construction. We are working to build resilient client portfolios in a few ways: In equity portfolios, we are continuing to invest in companies with strong balance sheets and through-cycle growth drivers. In fixed income portfolios, we are limiting duration risk while focusing on higher quality credits. We are also continuing to diversify around those core equity and fixed income building blocks with allocations to other asset classes like cash, real assets, and alternatives where it is appropriate.

Our experience over these last few years has underscored how quickly the market landscape can change. As such, we are hesitant to offer bold predictions for the new year; however, we are optimistic that those principles will help your portfolio weather the macro and market cycle, whatever 2023 may bring.

CY22 and 4Q22 Market Performance

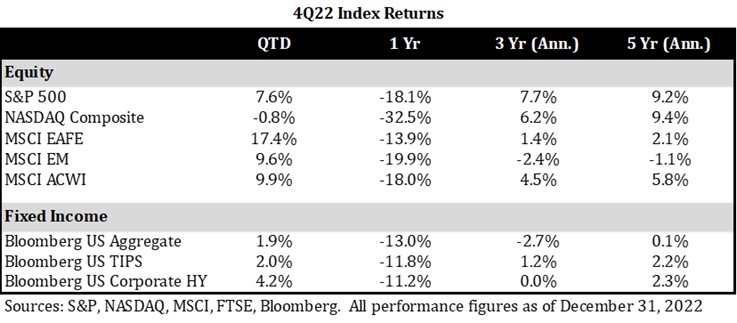

Equity and fixed income markets recovered from their September trough over the 4th quarter, as inflation moderated, and the Fed slowed its pace of rate hikes. Despite that, equity and fixed income investors still ended 2022 with losses. Over the full year, a 60% MSCI ACWI Global Equity / 40% Bloomberg Global Aggregate Fixed Income asset allocation index returned -17.5% – that marked the worst calendar year performance for that asset allocation index since its -23.4% return in 2008:

Within fixed income markets, while our short duration bond-focus helped to mute the impact of extreme inflation and Fed rate hikes, those headwinds still weighed on returns.

Cross-Asset Outlook

The Fed embarked on a path of aggressive rate hikes last year, increasing the Fed Funds Rate from 0 to 4.25% in just 9 months. That rapid rate hiking cycle led to historically poor bond returns. The Bloomberg US Aggregate index, the most widely used domestic core fixed income index, returned -13% over 2022, marking its worst calendar year performance since its inception in the 1970s.

While we did not expect that extreme a hiking cycle coming into the year, we were well-positioned for climbing rates in a number of ways across clients’ portfolios: We allocated to bond managers with less duration than the Bloomberg Agg, we added to cash and short-term treasury bills, and we focused on higher quality credit managers while limiting exposure to riskier securities like junk bonds.

Our shorter duration focus was additive over 2022, as more interest rate sensitive bonds struggled. We also believe that our high-quality credit focus will contribute to portfolio resilience longer term. This has been a recurring theme in recent conversations with fixed income managers; the managers we work with are positioning portfolios to avoid credit quality deterioration in the event of a recession. Moreover, after last year’s rate hikes, investment grade bonds offer attractive current income for the first time in over a decade. Today, the Bloomberg Agg yields over ~4.5%, offering some of its healthiest current income since 2009. So, while bonds were poor diversifiers over 2022, their increasingly competitive yields and potential diversification benefits into a recession support the strategic case for the asset class.

Equity Strategy Highlight

We are similarly focused on balance sheet quality and business cycle resilience in clients’ equity portfolios. Costco Wholesale (COST), the US superstore, fits neatly into that framework and helps illustrate that focus.

Over its 40-year history, Costco has established a reputation for delivering exceptional customer value while treating employees well. That focus goes back to Costco’s founder, Jim Signal, who framed the company’s mission as generating sustainable growth by delivering higher quality at lower prices than competitors. Their identity has been rewarded with Costco now boasting over 65 million paying Costco club members, very low membership churn, industry leading employee retention, and a peer group leading net promotor score.

When we first added Costco to portfolios over six years ago, our investment thesis rested on a belief that the firm’s strong customer value proposition would help it outgrow peers through the business cycle. That has borne out over the last three years. In 2020, when COVID reshaped consumer shopping habits, Costco was positioned to benefit, outgrowing its median peer. In 2021, when consumer spending habits began to normalize but retail spending remained healthy, Costco once again outgrew its median peer. And in 2022, when soaring gas prices squeezed consumers, Costco attracted shoppers with its low margin gas stations, driving industry leading growth. Moreover, while Costco isn’t immune to the economic cycle, its unparalleled customer value proposition could drive sustained growth in a slowdown. This is consistent with the company’s track record: Between 2006 and 2009, when unemployment soared and competitors struggled, Costco took market share from its big box peers by helping families manage tighter budgets.

Costco’s fortress balance sheet should also add to its business cycle resilience. The retailer carries more cash on its balance sheet than it has debt outstanding, its bonds are rated A+ by S&P Global Ratings, and its management team has a long track record of conservative capital allocation. The company’s management frames that philosophy as a Berkshire Hathaway approach, and it comes by that influence honestly: Berkshire’s vice chair, Charlie Munger, has been on Costco’s board of directors since 1999.

Costco’s strong balance sheet and exceptional customer value proposition should continue to support value creation through the business cycle. We believe the retailer will remain an attractive core consumer staples holding long term.

Conclusions

The end of the year can offer a valuable opportunity to look back, reflect, and plan for the year ahead. One of our biggest takeaways from 2022 has been that the speed of this business cycle underscores the need for a balanced through cycle approach to portfolio construction.

We believe the core tenants of our investment approach will continue to add value in this fast-moving environment. Specifically, we believe US equities continue to represent an appropriate core allocation for most clients and that focusing on portfolio company balance sheet health and through-cycle value creation drivers will add value within equity markets. Similarly, we believe higher quality fixed income will continue to play a role in portfolios. Lastly, we will continue to look for opportunities to diversify around those core portfolio building blocks with allocations to cash, real assets, and alternatives.

We do not have a crystal ball, and these last few years have underscored how quickly the market landscape can shift under our feet. As such, we will refrain from offering bold predictions for the new year. However, as we move into 2023, we will continue to look for investments that can contribute to long term returns while providing diversification through the market cycle.

We wish you all the best for the new year. Please do not hesitate to reach out if you have any questions about your portfolio or our market outlook.