2023 3rd Quarter Client Letter – Market Moves and Manufacturing Momentum

By Will Klein, CFA, Kaitlyn Fagundes

Quarterly Investment Commentary

Tax Credits, Trade Tensions, and a Manufacturing Renaissance

Through the first nine months of this year, a small group of tech and AI companies have powered the bulk of the US stock market’s returns. However, growth in the real economy has been much broader, with some of the most significant signs of growth being seen in manufacturing. The Census Bureau estimates that investment in new manufacturing facilities has more than doubled from pre-COVID levels. This is also evident in the deluge of industrial megaproject announcements over the last few years; for instance, economists at the Dallas Fed recently identified over $40B in US battery manufacturing investment announcements made over the past two years. The key drivers behind this domestic manufacturing boom have been companies’ response to subsidies incentivizing domestic manufacturing of electric vehicles and semiconductors, as well as geopolitical pressures, with US/China tensions driving American companies to shift their supply chains to the US. These unresolved and rising tensions could perpetuate this increased domestic manufacturing investment.

This dissonance between a stock market powered by tech companies and a real economy partly powered by manufacturing investments is presenting some opportunities for investors. While we continue to favor tech leaders, we are also focused on owning the winners from this onshoring and manufacturing investment boom. We are optimistic that this balanced approach to equity portfolio management will add value in this uncertain market environment.

3Q23 Market Performance

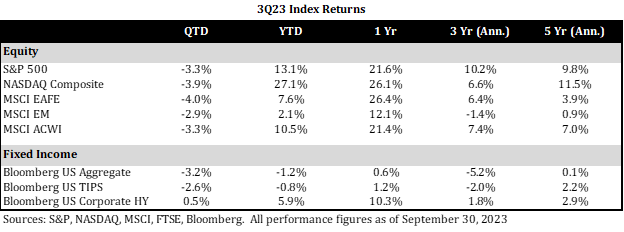

While global equity markets retreated from their previous highs over these past three months, the S&P 500 continued to lead the international markets with the dollar strengthening over this third quarter; our US-equity focus was rewarded in that environment.

In fixed income, some ground was lost as Fed policy makers signaled sustaining current elevated interest rates well into the next year. However, our allocation to treasury inflation protected securities (TIPS) helped in our fixed income sleeve, as inflation expectations rebounded from their previous second quarter lows.

Cross-Asset Outlook

US onshoring in manufacturing has come hand-in-hand with slowing Chinese export growth, contributing to a struggling Chinese market. The export slowdown, paired with a property market slump, pushed Chinese equities 6% lower year-to-date (as measured using the MSCI China Index), extending a longer losing streak for Chinese equity markets. The MSCI China Index has delivered -26% total return since the end of 2019, making it the only major equity market trading below pre-COVID levels.

While our longstanding US equity market focus predates the current US manufacturing boom and China’s ongoing economic slowdown, those dynamics have proven favorable to our strategy with the US markets outperforming both emerging and international-developed markets this year. While we do see value in international markets—and will continue to monitor for regional diversification—we believe US markets will continue to represent the core equity allocation for clients long term. Our view is grounded in the belief in what Warren Buffett dubbed the “American Tailwind”: the idea that US companies, with the premium they place on entrepreneurship, innovation, and efficiency, will continue to create exceptional value for investors over a strategic horizon.

Equity Strategy Highlight

While we invest in several companies that are benefitting from this domestic manufacturing investment boom, the portfolio holding most aligned with that trend is United Rentals (URI).

Founded in 1997, United Rentals has pursued both strategic and bolt-on acquisitions and invested in organic growth to become the national leader in the historically fragmented equipment rental market. Those investments have transformed what started as a modest leasing company into a multinational, integrated network with over 1400 locations managing a rental fleet comprised of everything from cranes and backhoes to modular office trailers and generators.

United Rentals’ leading scale should represent a significant competitive advantage today. Across the country, we are seeing a spike in construction activity with a wave of multi-billion dollar manufacturing and infrastructure projects. The breadth and depth of United Rentals’ fleet, as well as its proprietary data analytics and training solutions, makes it uniquely well-suited to service those major projects.

Additionally, United Rentals screens well across our quality criteria. Their investments in machinery safety, customer training, and energy efficiency have earned them a strong reputation among contractors. They have a track record of creating value through acquisitions of smaller, less well-managed rental companies, a history of proactively managing their fleet size and debt load to grow the company through the business cycle, and a management team that thinks like shareholders.

United Rentals’ exposure to manufacturing investment tailwinds, historically strong balance sheet, and track record of creating value through the cycle were key to our thesis when we added the stock to portfolios early last year. Today, we are increasingly convinced the company will be able to capture tailwinds from the current wave of manufacturing onshoring and infrastructure investment. While we continue to monitor the stock, we believe United Rentals will remain an attractive industrial holding long term.

Conclusions

While market returns have been favorable over the first nine months of the year, upward pressure on interest rates, paired with narrow equity market leadership, continue to represent a challenging investment landscape. Our approach to navigating that landscape remains unchanged; We continue to believe US equities represent an attractive core allocation for long-term investors, and that investment grade fixed income offers competitive yields and diversification benefits.

As always, please do not hesitate to reach out if you have any questions about these market themes or your portfolio.