2025 2nd Quarter Client Letter – Liberation Day Volatility and the Case for a Long Term Perspective

By Will Klein, CFA

Quarterly Investment Commentary

Staying the Course through Stormy Seas

Last quarter started out with a shock. On April 3rd, the Trump Administration unveiled “Liberation Day” tariffs that would raise the effective tax rates on US imports from below 5% to more than 25%, marking the largest tariff increase in over a century and threatening economic growth and corporate earnings. The market response was immediate and severe: Over the four trading sessions following that tariff announcement, the S&P 500 declined to ~20% below its February peak. That marked the swiftest bear‐market drawdown since the onset of the COVID pandemic in March 2020.

Policy reversals emerged with similar speed. By mid-April the administration announced a 90‑day suspension of most new bilateral duties. In early May a tariff truce with China further reduced the odds of a trade war induced recession. By quarter‑end, the S&P had fully retraced its April drawdown to end June up over 6% year to date.

Though the speed of that market selloff and recovery was intense, it followed a familiar pattern. Since 2020 investors have weathered significant shocks – from the COVID pandemic to Russia’s invasion of Ukraine – and now tariff turmoil. Each of those episodes prompted steep double digit market declines followed by swift recoveries. Those fast moving market rotations echoed a longer-term pattern. Historical research by the economist Peter Oppenheimer indicates that over the last 150 years bear markets triggered by exogenous shocks have generally resolved faster than those caused by financial crises or restrictive monetary policy. Guided by that insight, we maintained strategic discipline through last quarter’s market turbulence.

Looking forward, there is no shortage of risks on the horizon. From conflicts in the Middle East and Ukraine to trade tensions and fiscal policy debates, the world feels incredibly uncertain. A crisis on any of those fronts could reignite market volatility. While we take those risks seriously, we firmly believe that a disciplined long-term investment strategy coupled with proactive diversification across equities, fixed income, alternatives, and real assets remains the best approach to preserving and growing wealth through uncertain times.

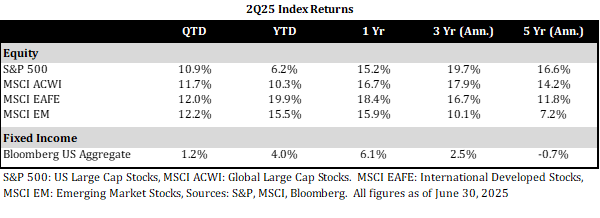

2Q25 Market Performance

While trade tensions rattled the stock market over the first half of the year, our diversification strategy demonstrated its value. Between the February 19th S&P market peak and the April 8th market trough, investment‑grade bonds and alternative investments including reinsurance funds and private credit strategies delivered positive returns. Meanwhile, real assets including listed infrastructure and real estate investment trusts (REITs) declined less sharply than equities. Lastly, gold advanced, showing its value as a crisis hedge. So, while that sell off was brief, it validated our thesis around those portfolio building blocks.

International equities led US stocks again over the second quarter, supported by a weakening dollar and stimulus hopes in China and Europe. Although we’ve modestly increased international exposure over the past six months, we continue to favor US equities for a couple of reasons: We believe in the structural advantages including strong corporate governance and economic dynamism that have historically powered US outperformance, and think the abundance of growing, innovative, well-managed businesses here in the US makes the US equity market the best pond in which to fish.

Meanwhile, core fixed income returned 1.2% over the second quarter. While ongoing budget negotiations may fuel near term interest rate volatility, our focus on less rate sensitive bonds should continue to insulate portfolios from that risk. Additionally, with bond yields near their 20 year highs, we believe investors are being compensated for holding higher quality bonds today.

Conclusions

Recent market volatility reinforces our commitment to balanced portfolios. Within equities, we remain optimistic that our investment process, which stresses business stability and through-cycle earnings growth potential, should add value if leadership broadens out or we return to a more challenging market environment. Additionally, we believe allocations to fixed income, alternatives, and real assets can play a key role in stabilizing portfolios in this uncertain environment. Our investments across real asset and alternative strategies over the last three years reflect that view.

We appreciate your trust in us through this period of market turbulence. As always, please reach out with any questions about your portfolio or our market outlook.