2025 3rd Quarter Client Letter – AI Tailwinds, Hiring Headwinds, and Fed Rate Cuts

By Will Klein, CFA

AI vs. the Everything Else Economy

It is a cliché that the economy and the stock market are not the same thing – that is true enough. But markets can still tell us a lot about the economy. Today they are telling a tale of two economies: An AI economy that is booming, and an “everything else” economy that is delivering more muted growth.

It is difficult to overstate the scale of today’s AI spending boom. In 2022, the year ChatGPT launched, the five largest US cloud platforms – Amazon, Microsoft, Google, Meta, and Oracle – invested ~$125B in data centers. Three years later, data center investment from those cloud titans is on track to increase threefold, to ~$375B, in 2025. Recent mega project announcements suggest that spending may continue to grow. Last month Oracle and OpenAI announced plans to build a 4.5-gigawatt AI data center campus in West Texas that will consume more than twice the power generated by the Hoover Dam. Not to be outdone, Amazon, Microsoft, Google, and Meta have also announced plans to accelerate their investments in AI infrastructure. Whether AI usage will justify this data center investment near term is unclear, but that is not slowing down spending. Meta’s Mark Zuckerberg captured the mindset driving this investment boom in a recent interview when he said he would rather risk misspending hundreds of billions of dollars than risk falling behind in the AI race.

Meanwhile, the rest of the economy is growing more slowly. The divergence is most acute in the labor market where monthly job gains have fallen from >500K in late 2021 to ~30K over the last three months. Consumer spending is also slowing down, with companies like Walmart and McDonald’s citing weaker demand from lower-income consumers. Our tilt towards less cyclical, more up-market consumer companies is insulating us from those headwinds today, but some portfolio companies are still feeling that slowdown.

The bifurcation between the extremely strong growth in AI investment and the slower growth in employment and consumer spending has driven a decoupling between AI stocks and the rest of the market. Equity market breadth is historically narrow: the 10 largest S&P 500 constituents now make up over 40% of the index, and most of those companies are tech or AI leaders. Even more dramatically, research from JPMorgan’s Michael Cembalist finds that “41 AI related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth, and 90% of capital spending growth since ChatGPT launched in November 2022.” Per Cembalist’s analysis, if you exclude those AI stocks, the S&P’s annual appreciation since the launch of ChatGPT falls from a historically strong ~19% to a more average ~8%.

As always, we are striving to stay balanced in this increasingly concentrated market. To that end, we are pairing durable, cycle-tested non-AI businesses with tech and energy businesses that are participating in this AI boom within clients’ equity portfolios. We are optimistic that balanced approach will deliver participation in this AI boom, while managing downside if this AI capital spending cycle slows.

3Q25 Market Performance

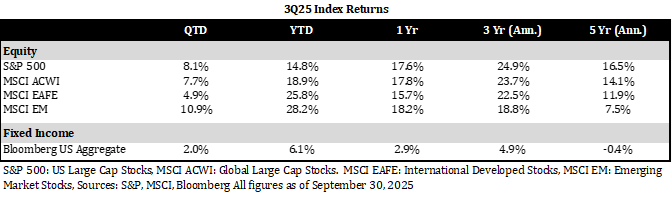

Soaring AI stocks drove strong US market performance over the third quarter. Chinese tech stocks also participated in that AI rally, powering emerging market indices higher. Meanwhile, international developed markets and core fixed income delivered more muted, but still healthy returns:

Bond market returns were supported by the Fed’s shift back towards rate cuts. At the Jackson Hole conference in August, Fed Chair Jerome Powell struck a dovish tone, signaling concern about labor-market softness and hinting at future rate cuts. In September, the Fed followed through on those comments, lowering the Fed funds rate from 4.25% to 4%, and more rate cuts could be on their way. Futures are pricing in several additional Fed rate cuts over the next 12 months as central bankers respond to weaker labor market conditions. Leadership changes at the Fed could support this rate-cutting trajectory, with Powell’s term as Fed Chair ending next May, and Trump seeking to appoint a more dovish Fed Chair as his successor. While rate cuts could support growth, they could also re-accelerate inflation. As such, we continue to guard against inflation risks with allocations to Treasury Inflation Protected Securities (TIPS), gold, infrastructure, and Real Estate Investment Trusts (REITs).

The recently announced federal government shutdown, which began on October 1st, does not change our macro views or market positioning. This marks the fifth federal shutdown since 2010. Recent history shows these episodes have very limited macro impact, as deferred pay to federal employees is reversed with back pay. Markets have likewise tended to shrug off these impasses, with shutdowns not historically linked to meaningful moves in equity or fixed income markets. That said, if Trump follows through on threats to fire Federal workers in the shutdown, that could have a more significant impact.

Conclusions

Recent market strength underscores the value of a core allocation to large cap US equities. Within US equities, we remain optimistic that our emphasis on business stability and through-cycle earnings growth should help provide balance in an increasingly top-heavy market. Meanwhile, we continue to use fixed income, alternatives, and real assets as diversifiers that can stabilize portfolios through periods of macro uncertainty and market volatility, while contributing to total returns.

As always, please reach out with any questions about your portfolio or our market outlook.