2025 4th Quarter Client Letter – Positioning Portfolios for a K-Shaped Economy

By Will Klein, CFA

Quarterly Investment Commentary

Growth, Volatility, and the K-Shaped Economy

2025 was a turbulent year for markets. The year began under a cloud of trade policy uncertainty reaching a crescendo in April when tensions peaked, recession fears spiked, and markets fell ~19% following President Trump’s “Liberation Day” tariff announcements. However, as the year progressed, two tailwinds emerged to more than offset those policy headwinds: Accelerating investment in Artificial Intelligence infrastructure, and strong upper-income consumer spending. Meanwhile, trade deals helped us avert a tariff-induced recession. Together, those drivers ultimately propelled strong market returns: The S&P 500 ended the year up ~18%, marking the index’s third consecutive year of double-digit returns. This served as a reminder that while policy shocks can trigger bouts of volatility, we believe earnings and economic growth ultimately drive long term returns, which should reward investors who take a long term perspective.

As we turn the page to 2026, the forces that supported last year’s market returns remain in play, but a significant risk is building beneath the surface: a widening gulf between the economic haves and have-nots. The economist Peter Atwater memorably dubbed that divergence the “K-Shaped economy”. Today, the sustainability of this “K-Shaped” economy appears likely to become the defining theme of the coming years. On the upper slope of the K, technology companies with exposure to AI innovation appear poised for continued near term growth. Conversely, on the lower arm of the K, cyclical industries like autos, housing, and transports are exiting a year of anemic growth on uneven footing. This divergence is unlikely to be sustainable. As we look ahead, we are watching for one of two resolutions to this market divergence: A broadening out, where fiscal stimulus and easing monetary policy ignite a catch-up trade for last year’s laggards, leading to a healthier bull market, or a reversal, if today’s winners hit a fundamental air pocket. The key question for 2026, and the rest of the decade, is whether this “K-Shaped” macro and market environment resolves with a wider market rally, or a rapid reversal for recent leaders.

In an environment characterized by such stark contrast between the haves and have-nots, we believe a balanced approach is the only prudent path forward. We continue to allocate to high-quality core US equities, and we expect they will remain an important driver of returns. However, we are complimenting that exposure with allocations to asset classes including fixed income, alternatives, and real assets to maintain diversification. We believe this will help position portfolios to participate in the upward-sloping part of this K-shaped economy, while providing ballast if key drivers of strong recent market returns, such as AI investment and high-income consumer spending, begin to slow.

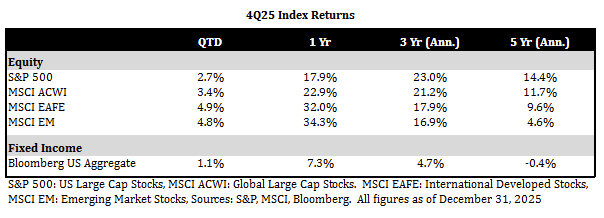

4Q25 and FY25 Market Performance

While equity markets delivered strong total returns over 2025, currency and fixed income markets also played a key role in driving portfolio returns. After a challenging start to the decade, 2025 provided a much-needed reprieve for bond investors. Core fixed income markets returned ~7%, delivering their strongest returns in years, as the Federal Reserve cut short-term interest rates to ~3.5%. Looking ahead, however, the outlook for core fixed income has become more nuanced. While further Fed cuts may continue to support shorter-duration bonds, inflation uncertainty and a softer US dollar could pose risks for longer-term bonds – that informs our tilt towards short-term and intermediate term fixed income.

US dollar weakness was also a key driver of relative equity performance in 2025. While US equities posted strong results, they lagged international equities over the full year, and this divergence was largely a currency story. The ICE US Dollar Index declined by ~10% in the first half of the year. For US-based investors, this meant that international companies were buoyed because their home country currencies strengthened against the dollar.

As we look into 2026, currency volatility could persist, driven by factors including leadership changes at the Fed, commodity price swings, and the simple reality that the dollar is lapping a period when it was historically expensive. While we are not forecasting an end to the dollar’s global dominance, we believe that the era of steady dollar strengthening (which has favored US-centric portfolios since 2007) is being tested. This reinforces our case for owning real assets, including precious metals, infrastructure, real estate, and natural resources equities, which can benefit from a weaker currency. These allocations were solid contributors to performance in 2025, and we expect them to remain a vital ballast for portfolios as we head into 2026.

Conclusions

Many of the drivers that powered markets higher last year remain in place as we look ahead to 2026. However, the growing disconnect between the economic haves and have-nots, alongside macro risks such as Fed policy uncertainty and currency volatility, could pose risks to this strong run of market returns. Rising geopolitical tensions also bear watching. As the recent US Military operation that captured Venezuelan leader Nicholás Maduro underscored, those conflicts can escalate quickly, impacting global markets. With those risks in mind, we continue to see a compelling case for maintaining a core allocation to large-cap US equities. Within US equities, we remain optimistic that our emphasis on business stability and through-cycle earnings growth can provide balance in an increasingly top-heavy market. Additionally, we see an expanding role for portfolio diversifiers, including real assets and alternatives, as well as core fixed income, in the face of elevated macro uncertainty.

As always, please reach out with any questions about your portfolio or our market outlook.