Debt Ceiling Crisis

By Will Klein, CFA

Client Update

As you may be aware, the US Treasury reached its borrowing limit this past January. Over the last four months, the Treasury has managed around that constraint by employing extraordinary measures such as deferring contributions to public pension plans. However, if Congress does not increase that borrowing limit over the next few weeks, the Treasury could run out of funds this June, which could result in a technical sovereign default.

We believe Congress will ultimately hike the debt ceiling, avoiding a technical default. So while we are closely monitoring the macro and market implications of ongoing debt ceiling negotiations, we are staying the course, as always, and not making any significant changes to client portfolios in response to this potential crisis.

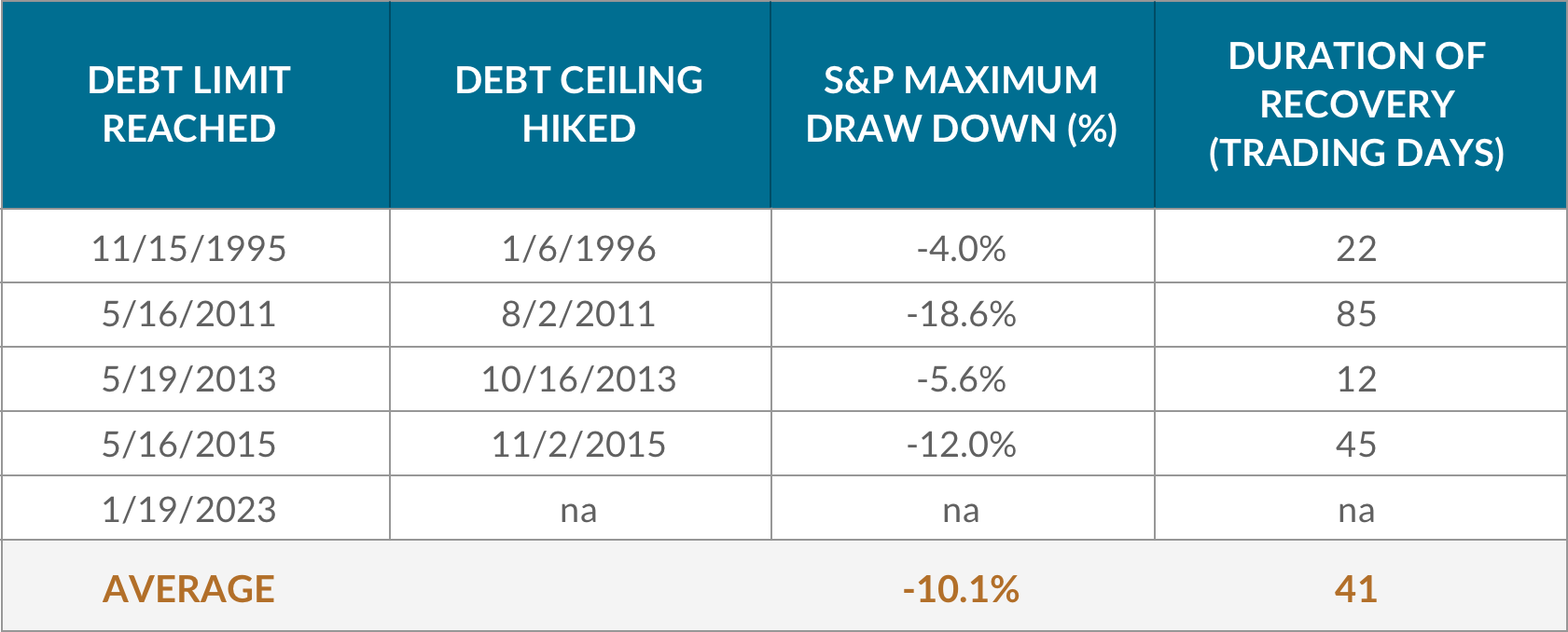

Since Congress first established the debt ceiling in 1917, placing a statutory limit on the amount of debt the Treasury can have outstanding, the legislature has hiked that borrowing limit over 90 times. On four of those occasions—in 1995, 2011, 2013 and 2015—those hikes proved contentious. In each of those instances, equity markets struggled in the run up to a deal, but quickly recovered once leaders in Washington reached an agreement:

S&P 500 Selloffs Around Debt Ceiling Crises

The current negotiations around the debt ceiling resemble those recent crises. Congressional Republicans are using the debt ceiling as leverage to gain concessions from a Democratic Administration. Moreover, these negotiations could be resolved in a similar manner, with Congress raising the debt ceiling at the eleventh hour, in exchange for budget cuts, spending caps, or the creation of a deficit reduction commission.

Here at Baldwin Wealth Partners, we use a historical perspective to inform our outlook. While we cannot predict the specifics of a deal, if these negotiations culminate in a last-minute agreement, we could see elevated market volatility in the lead up to the Treasury’s June deadline. Investors could be rewarded for holding steady through that market turbulence.

We are always happy to discuss this debt ceiling crisis, and any other recent market developments. Please do not hesitate to reach out if you have any questions.