2024 1st Quarter Client Letter – Navigating Today’s Narrow Equity Market

By Will Klein, CFA, Zach Shirilla, CFA

Quarterly Investment Commentary

Staying Balanced in the Face of Growing Equity Market Concentration

The S&P 500 delivered healthy returns over the first three months of 2024, ending March with a year-to-date gain of ~10.6%. That brought the index’s trailing 12 month returns to ~31.8%. However, over those same 12 months, the median stock in the S&P 500 rose by a more modest ~17%. This speaks to a growing bifurcation between the large tech leaders that are propelling the index’s exceptionally strong returns and the rest of the market, which is driving a spike in market concentration.

Today, the weight of the 10 largest companies in the S&P index has climbed to a multi-decade high of ~33%. This rise has inspired some pundits to draw parallels between this rally and previous concentrated bull markets like the Dotcom boom. However, though there are a few similarities between today’s environment and the Dotcom period of the late 1990s (for instance, many of today’s market leaders are benefitting from a wave of enthusiasm around new generative AI technologies, echoing the enthusiasm for internet companies of the Dotcom era), history may not repeat itself. Today’s market leaders, like Amazon and Microsoft, are fundamentally healthier than the tech leaders of the late 1990s, and while today’s leaders trade at a premium to the rest of the market, their valuations are nowhere near the extremes of the early 2000s. Given this, parallels to the Dotcom period could be overstated, so we are comfortable continuing to own many of the large companies that have propelled markets higher.

While we will continue to own many of those large market leaders, we are staying balanced across client equity portfolios and investing in companies like Garmin outside of the very largest stocks, which could benefit from a broadening out of market leadership. We are optimistic this approach will be rewarded if we do ultimately see some mean reversion in market leadership, whether that takes the form of a “catch up” from market laggards or a “catch down” from market leaders.

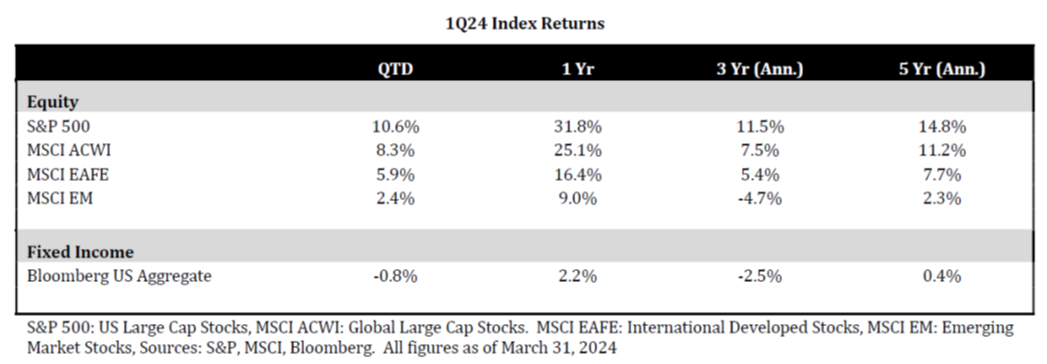

1Q24 Market Performance

Strong recent US large cap tech returns have had significant cross-asset performance implications. Most notably, they’ve contributed to a continued divergence between domestic and international equity markets. Over the last 12 months, the MSCI ACWI ex US Index, which captures the performance of international stocks, returned ~14%, lagging US equities by over 17%. Our domestic equity focus put us on the right side of that sustained US leadership regime.

Meanwhile, fixed income delivered lackluster returns over the first quarter as Fed rate cut hopes moderated in the face of persistent ~3% inflation. While the Fed is still on track to cut rates from today’s ~5.25% level this year, that easing could be more gradual if inflation remains entrenched. Our allocations to Treasury Inflation Protected Securities (TIPS) and Municipal bonds within fixed income helped insulate clients from those shifts in inflation and rate expectations over the quarter, but clients’ fixed income portfolios were not immune to those headwinds.

Equity Strategy Highlight

At Baldwin, we focus on large cap companies within our core equity strategy, and many of our largest positions like Apple, Amazon, and Microsoft are among the biggest companies in the world. However, we’ve also found success investing in companies like Garmin at the smaller end of that large cap universe. First bought in 2018, Garmin has been profitable every year since its IPO in 2000, and currently commands a market valuation of over $25B, falling solidly within our large cap investible universe. Though it is a fraction of the size of its largest consumer electronics competitor, Apple, it has managed to thrive by focusing on niches where it can outcompete that tech juggernaut.

Garmin was founded in 1989 as the first commercial manufacturer of GPS navigation devices. For much of its history, it was best known for its portable GPS devices which could be suctioned to car windshields. The sales of those devices peaked at 74% of company sales in 2007 but declined every year since then as consumers increasingly used their smartphones or built-in navigation displays for directions. Today, sales of those devices account for <6% of the business. However, the company’s culture of innovation and cash-rich balance sheet enabled them to pivot and grow into several other attractive and growing end markets. For instance, the company became the market leader in marine electronics and aviation cockpit controls for small and medium body jets. Additionally, Garmin now makes best in class adventure watches and handheld navigation devices, cycling equipment, and built-in automotive infotainment systems. Together, the company’s investments in those more specialized, higher end products in market niches that are too small for mega cap peers like Apple to compete in have powered it to significantly higher profits than it boasted at the peak of its GPS device business.

The success of Garmin’s smartwatches, namely the Epix and Fenix watches, in the face of significant competition from the Apple Watch, is a testament to the technical merit of their products and the brand they have built among extreme athletes and adventurers, which extends to weekend warriors. That brand has been built upon 35 years of pioneering and product development and continues today through investments such as the recently opened Firstbeat Analytics Lab, a state-of-the-art research and testing facility to help athletes reach their goals while fostering product innovation for Garmin devices.

Additionally, the company’s management philosophy and culture are competitive differentiators. The company’s CEO Clifton Pemble was one of Garmin’s first hires. Further, Dr. Min Kao, who serves as Chairman of the Board, and the son of his co-founder Gary Burrell, own a combined 19% of the business. The strong culture of stock ownership permeates down to middle-management, with one long-tenured employee holding more than $30M of company stock as of February 29th. That rare level of company stock outside of the c-suite is emblematic of the culture of ownership and long-termism at Garmin.

Garmin’s culture of innovation, long-term philosophy, and cash-rich balance sheet should continue to support their leadership across multiple end markets. Their diversification from serving those disparate end markets should also help stabilize operating results over the business cycle. Moreover, we believe the niche player could be a relative winner from any broadening out in market leadership. As such, we believe Garmin will remain an attractive core holding long term.

Conclusions

Investors have benefited from extraordinarily strong US equity market returns over the last 12 months. However, the narrow, concentrated nature of this bull market has made for a more challenging investment environment than the headline index returns might suggest. Our exposure to high quality tech leaders with leverage to thematic growth drivers like AI has helped us participate in that bull market. However, we haven’t been immune to the challenges of that increasingly concentrated, top-heavy rally.

We believe our balanced exposure across the largest high quality tech leaders and more off-the-beaten path names within our large cap investable universe will add value while limiting risk long term. Moreover, on a cross asset level, we believe US equities will continue to represent an appropriate core allocation for most clients and that higher-quality fixed income will continue to play a role in portfolios. We will continue to look for opportunities to diversify around those core portfolio building blocks with allocations to cash, real assets, and alternatives.

As always, please do not hesitate to reach out if you have any questions about these market themes or your portfolio.