The Ukraine Crisis and its Market Implications

By Will Klein, CFA

Client Update

Like many of you, we are deeply concerned over Russia’s invasion of Ukraine. That incursion marked the most blatant act of aggression on the continent since World War II. It has already taken a tragic human toll, and the path forward in Ukraine is far from certain.

While we are closely monitoring the macro and market implications of this conflict, we are staying the course within client portfolios.

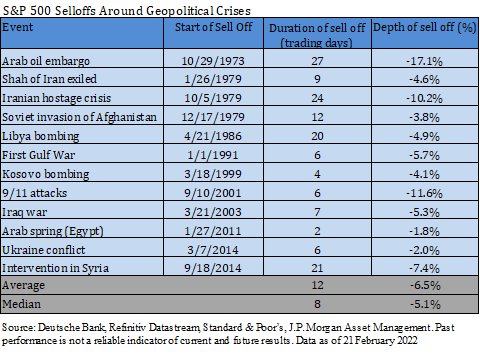

Over the last 50 years, we have seen a dozen geopolitical shock-linked US market sell offs. Many of those crises felt insurmountable at the time, but those market panics were usually short lived, as summarized below:

We believe US focused portfolios are well-positioned to weather this storm. Europe has historically imported 25% of its oil and 30-40% of its natural gas from Russia, and with regional inventories already low, cuts to Russian oil and gas exports could trigger an energy crisis across the continent. In that scenario, the US economy wouldn’t be immune: Higher oil prices could further fuel inflation while hurting households at the pump. Moreover, Europe represents a significant trade partner for the US. That said, US investors should be less impacted in that scenario than their international peers. That insulation from geopolitical risks informs our domestic tilt across client portfolios.

As has happened in the past, we are optimistic that investors will once again be rewarded for staying the course through this crisis. As such, we are keeping our eyes on the horizon through today’s stormy seas.

Please do not hesitate to reach out if you have any questions.